Key Takeaways

- Metaplanet acquired 463 BTC for approximately $54 million, bringing total holdings to 17,595 Bitcoin (BTC).

- Metaplanet’s latest purchase brings total Bitcoin holdings to over $1.7 billion.

- Fully diluted share count rose to 874.3 million, with additional increases expected.

- BTC Yield dropped to 24.6% as share dilution outpaced BTC accumulation.

Metaplanet Inc., one of Japan’s most aggressive corporate Bitcoin accumulators, has announced the acquisition of an additional 463 Bitcoin as part of its ongoing treasury operations, bringing the company’s total holdings to 17,595 BTC.

The latest purchase was made at an average price of ¥17,268,320 (approximately $116,646) per Bitcoin, with an overall value of ¥7.995 billion (around $54 million), pushing total Bitcoin holdings to a market value of over $1.7 billion.

Treasury Keeps Climbing, But BTC Yield Slows

While Metaplanet’s Bitcoin reserves continue to expand, growth in its key performance metric, BTC Yield, has begun to moderate.

BTC Yield reflects the amount of Bitcoin attributable to each fully diluted share, offering a measure of how much value the company’s Bitcoin holdings are delivering to shareholders.

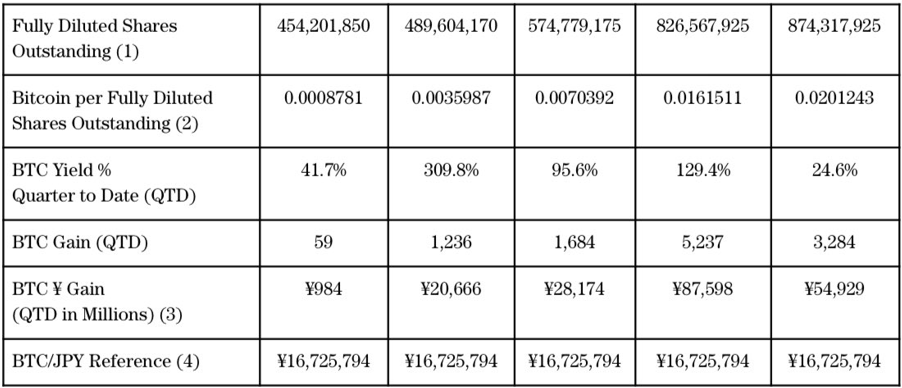

For the quarter-to-date ending August 4, 2025, BTC Yield stood at 24.6%, down from 129.4% in the second quarter and a peak of 309.8% in the fourth quarter of 2024.

However, as of August 4, each share corresponded to 0.0201243 BTC, up from 0.0161511 at the end of June.

While BTC per share continued to rise, the rate of that increase slowed significantly. The sharp moderation in BTC Yield appears tied to an acceleration in share dilution, with over 48 million new fully diluted shares added in the most recent period.

The trend marks a shift from earlier quarters when Bitcoin accumulation outpaced dilution, driving stronger BTC Yield growth.

Bitcoin Gains Rise, but So Do Shares

Metaplanet reported a gain of 3,284 Bitcoin for the quarter so far, valued at about ¥54.93 billion (approximately $371 million), based on an estimated average Bitcoin price of ¥16,725,794 (around $112,800)

In parallel, as of August 1, 2025, the company’s fully diluted share count stood at 874.3 million, reflecting all exercised stock acquisition rights to date and including the 10-for-1 reverse stock split completed on April 1.

Notably for shareholders, Metaplanet indicated that additional share conversions made on August 4 could push the total share count higher in future filings, with the BTC Yield metric adjusting automatically to account for these changes.

Final Thought: Can Bitcoin Keep Outpacing Dilution?

Looking ahead, investors may want to keep a close eye on how further share conversions affect per-share metrics, like BTC Yield, especially as Metaplanet continues to expand its Bitcoin reserves.

While the company’s aggressive accumulation strategy remains intact, its ability to deliver value on a per-share basis will increasingly depend on how it balances treasury growth against equity dilution.

Read More: Strategy Buys Another $2.5Billion in Bitcoin; Know the Details!