Key Takeaways

- Kiyosaki warned that Bitcoin, gold, and silver may crash soon, calling BTC a “bubble”.

- Just a week earlier, Kiyosaki had praised Bitcoin’s surge past $120,000, while warning against being greedy.

- Kiyosaki’s history of crash predictions, flagged by Brew Markets, has often proven inaccurate.

- Investors are urged to assess risks independently rather than rely on high-profile predictions.

Robert Kiyosaki, author of the best-selling personal finance book Rich Dad Poor Dad and a long-time advocate of Bitcoin, expressed a bearish outlook on his favored digital asset in a post on X, warning that Bitcoin’s “bubble,” along with those of gold and silver, may soon burst.

On July 21, Kiyosaki told his 2.5 million followers on X that “BUBBLES are about to start BUSTING,” warning that gold, silver, and Bitcoin could face sharp declines if broader market conditions deteriorate. Still, he framed the potential downturn as a buying opportunity, writing, “Good news. If prices of gold, silver, and Bitcoin crash…. I will be buying.”

Kiyosaki, known for his support of Bitcoin and bold predictions, including claims that BTC could reach $1 million, has recently started showing signs of caution.

In a July 14 post following Bitcoin’s surge above $120,000, he called the rally “great news for those who already have some Bitcoin” and said, “I am buying one more coin today.”

At the same time, he warned against getting carried away, writing, “Pigs get fat… Hogs get slaughtered,” and adding, “I am waiting until I know where the economy is going before I buy more.”

Kiyosaki referenced Warren Buffett’s $350 billion in cash holdings, suggesting the Berkshire Hathaway chairman was waiting for a market crash before investing. “Millions are about to become poorer,” he wrote. “I want you to become richer.”

Should we be worried?

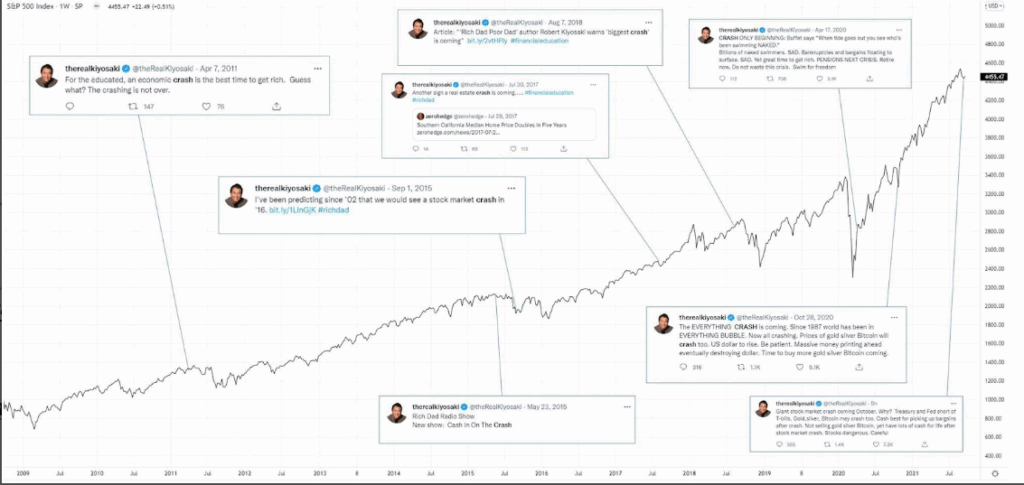

Kiyosaki’s recent warning is not his first. According to the market newsletter Brew Markets, the author of Rich Dad Poor Dad has repeatedly posted forecasts about imminent stock and cryptocurrency market crashes over the past decade, many of which did not materialize.

In April 2011, Kiyosaki tweeted that “an economic crash is the best time to get rich,” and added, “The crashing is not over.” In September 2015, he claimed he had been predicting a market collapse since 2002, expected to hit by 2016. No major crash occurred during that period.

Similar posts followed in 2017, 2018, and again in 2020, when Kiyosaki declared that the COVID-19 market crash was “only beginning.” However, the S&P 500 recovered swiftly and went on to reach new highs.

Similarly, In 2021, he warned of a “giant stock market crash” in October and suggested that gold, silver, and Bitcoin could all collapse. Markets instead rebounded.

Final thoughts:

The visual chart shows that despite Kiyosaki’s status as a prominent financial author, his repeated predictions of market crashes have often failed to align with actual outcomes.

However, Investors are advised to conduct their own research to assess whether a market downturn is imminent, rather than relying solely on individual predictions.

Read More: Strategy Eyes More Bitcoin as Treasury Tops $71B with 601,550 BTC