Key Takeaways

- Stablecoins are rising as gaming’s financial backbone, offering price stability and predictable value where volatile game tokens failed.

- Roblox and Fortnite show the model works, as fixed-value currencies like Robux and V-Bucks underpin billion-dollar creator economies.

- Regulatory clarity is boosting adoption, led by the U.S. GENIUS Act, Europe’s MiCA, and new frameworks in Asia.

- Stablecoins cut payment friction, reducing 2–3% card fees to near-zero and enabling instant global creator payouts.

- Smooth user experience is key, with embedded wallets and light KYC keeping blockchain invisible to players.

Table of Contents

The use of stablecoins is emerging as one of the most promising shifts in the global gaming economy, according to a new report by the Blockchain Game Alliance (BGA).

The study argues that price-stable digital currencies, such as stablecoins, could become the backbone of future game economies, replacing speculative tokens that have hindered sustainable growth in blockchain-based gaming.

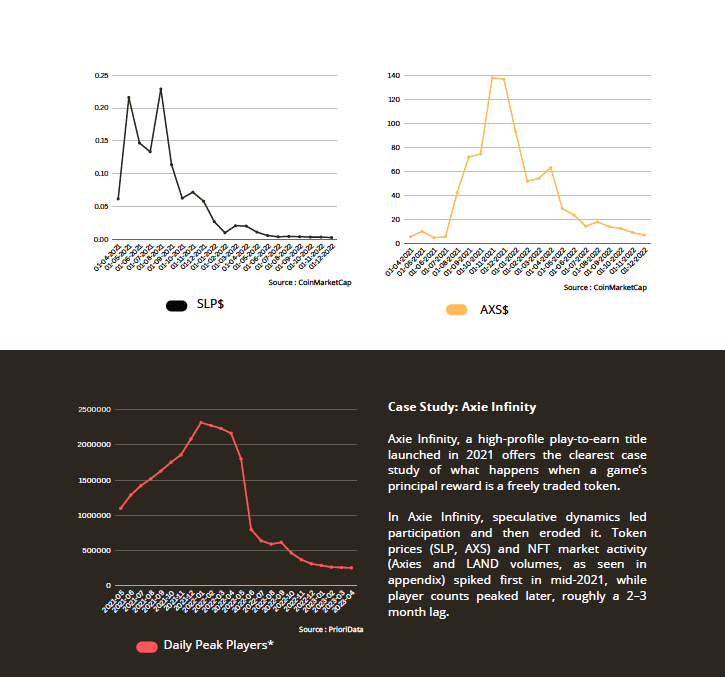

The BGA’s study notes that while early “play-to-earn” games attracted millions of users during the crypto boom, their dependence on volatile tokens created unstable economic systems. This fragility has pushed developers toward stablecoins — digital assets pegged to fiat currencies such as the U.S. dollar or euro — as a more reliable foundation for virtual economies.

From Speculative Tokens to Sustainable Economies

The BGA notes that speculative gaming tokens lost much of their value after the 2022 market correction, leaving both developers and players exposed to steep losses, adding that many gaming platforms have since abandoned such models in favor of more sustainable, utility-based economies.

In contrast, stablecoins offer a path toward sustainable, utility-based economies, where game currencies maintain consistent purchasing power. This shift supports new “play-and-own” models focused on ownership and creativity rather than speculative profit.

The report describes stablecoins as a potential monetary layer for games, capable of powering everything from micro-purchases and royalties to creator payouts and cross-border settlements.

Lessons from Roblox and Fortnite

BGA draws parallels with major non-blockchain platforms that already rely on stable-value in-game currencies. Roblox’s Robux and Epic Games’ V-Bucks maintain fixed exchange rates, allowing players and creators to operate in predictable economies free from speculation.

In 2024, Fortnite distributed $352 million in creator payouts, while the top 1,000 Roblox developers earned an average of $980,000 each, according to BGA data.

By replicating these stable-value models on-chain using regulated stablecoins such as (USDC) or (EURC), the report suggests that developers can combine blockchain interoperability with the economic stability that drives mainstream adoption.

Regulation Turning from Obstacle to Enabler

BGA emphasizes that regulatory progress across key markets is making stablecoin adoption more viable.

In the United States, the GENIUS Act formally defines “payment stablecoins” and limits issuance to licensed entities. The law requires one-to-one reserve backing, regular audits, and the ability to comply with lawful freeze or redemption orders.

Europe’s Markets in Crypto-Assets (MiCA) regulation is implementing similar rules, including licensing for issuers and mandatory redemption rights for token holders. The report says MiCA is expected to standardize the euro-denominated stablecoin market by 2025.

In Asia, Singapore, Hong Kong, and Japan are adopting parallel frameworks that promote reserve-backed, regulated tokens, effectively making stablecoins a compliant payment tool across major gaming markets.

The report says regulatory clarity is becoming an enabler rather than a constraint, adding that stablecoins now fit more closely within the compliance expectations of global financial systems.

Efficiency and Financial Inclusion

According to BGA, stablecoins promise significant cost savings and faster settlements compared to traditional payment rails.

Credit card processors typically charge 2%–3% in fees and take several days to settle cross-border payments, a costly drag for platforms managing millions of microtransactions, the report stated, suggesting that stablecoins could cut settlement costs to just a few cents per transaction and enable near-instant payouts.

The technology also enables programmable payments, allowing automatic royalty distribution and in-game reward systems that execute without intermediaries. the report noted.

Invisible Blockchain, Frictionless UX

To encourage mainstream adoption, BGA advises developers to focus on user experience rather than technical complexity.

The report promotes embedded wallets, automatically generated for users when they register, paired with tiered identity checks, where Know Your Customer (KYC) requirements apply only to larger transactions or withdrawals.

Such design keeps blockchain activity “invisible” to players, allowing them to transact with stablecoins without needing to understand wallets or private keys.

The report notes that blockchain functions work best when they remain invisible to the player.

Risks and Remaining Challenges

BGA cautions that despite their advantages, stablecoin integrations are not without risk. Game platforms that facilitate player-to-player token trading may fall under Digital Asset Service Provider (DASP) or money-transmission regulations, depending on jurisdiction.

The report also highlights operational issues, such as refunds and dispute resolution, which are routine in traditional payments but require new on-chain solutions, like escrow smart contracts or arbitration layers.

Additionally, unregulated or poorly backed stablecoins could reintroduce volatility and regulatory exposure, the BGA warns, urging publishers to partner with licensed issuers under recognized frameworks like MiCA or the GENIUS Act.

Conclusion

The shift toward stablecoin-based systems marks a broader evolution in gaming’s economic model, as the industry moves away from speculative, token-driven incentives toward stable, value-oriented digital economies.

At the heart of this change is the rapidly expanding creator economy, projected to exceed $350 billion by 2030, driving creators and developers to demand faster, fairer, and more transparent cross-border payments.

By enabling instant, low-cost, and auditable transactions, stablecoins could streamline payouts and reduce friction for both studios and players, while blockchain infrastructure ensures transparency and accountability.

The report concludes that stablecoins are likely to become the financial backbone of next-generation gaming, blending regulatory compliance with global accessibility.

If adopted at scale, this shift could fundamentally reshape how value moves through digital worlds, transforming games into stable, borderless economies that mirror real-world financial systems in both trust and reach.

Read More: Wyoming Rolls Out First U.S. State-Backed Stablecoin (FRNT) Across 7 Blockchains