Key Takeaways

- The Bank of England has proposed a new regulatory framework that would allow systemic stablecoins to enter everyday payments, but only under strict backing, capital and operational rules designed to protect financial stability.

- The plan replaces the earlier “all central-bank deposits” model with a mixed backing approach, requiring at least 40% in Bank of England deposits and allowing up to 60% in short-term gilts to support commercial viability.

- Issuers would face tough prudential requirements, including capital buffers, statutory trust arrangements and two dedicated reserves to ensure coin holders can be paid out quickly and in full if an issuer fails.

- Stablecoins that become widely used in retail, corporate or platform ecosystems could be designated as systemic, triggering holding limits, redemption protections and mandatory direct access to key UK payment systems.

- The Bank sets clear expectations for technology, custody and cross-border operations, signaling that public blockchains, overseas issuers and unhosted wallets may be permitted, but only if risks around resilience, safeguards and cooperation are fully met.

Table of Contents

The Bank of England has set out a detailed regulatory plan for systemic stablecoins that would be used for everyday payments in the United Kingdom, seeking to support innovation in digital economy while shielding financial stability and the banking system from sudden shocks.

In a long consultation, the central bank describes how it would oversee sterling-denominated stablecoins issued by non-banks once they become widely used for retail or corporate payments or as settlement assets in core financial markets. The framework is meant to sit alongside rules from the Financial Conduct Authority and future legislation from the Treasury, and to prepare for a future in which different digital forms of money circulate side by side.

Governor Andrew Bailey says the United Kingdom needs rules that anticipate the scale stablecoins could reach, rather than waiting to retrofit regulation after problems arise. The central bank argues that the rise of tokenised deposits, programmable payments and blockchain based settlement systems makes it necessary to design oversight before such coins are widely adopted.

Mixed Backing Model Replaces Earlier Plan

The Bank of England’s latest proposal shows a departure from the model set out in its 2023 discussion paper. The earlier framework required systemic stablecoin issuers to hold all backing assets as non-interest bearing deposits at the central bank. Industry participants warned that this structure would be commercially unworkable, especially for firms attempting to scale new payment systems.

The new framework introduces a mixed backing model designed to preserve safety while improving economic viability. Under the proposal, issuers would maintain at least 40% of backing assets as central bank deposits, ensuring a high degree of liquidity and stability. The remaining share, up to 60%, could be invested in short-term sterling government securities, in an attempt to balance user protection with the need for issuers to earn a modest return and operate sustainably.

The Bank notes that some issuers may experience temporary deviations from the prescribed ratio during periods of heavy redemptions. These firms would be required to notify the Bank and restore the mix within a reasonable period. The central bank is also considering a lending facility that could provide short term-iquidity against government bond holdings, offering a controlled mechanism to absorb redemption shocks.

To support early-stage projects, the paper introduces a step-up approach for coins that are recognized as systemic at launch. These issuers could begin with a higher proportion of government securities. As usage increases and the coin becomes more important for payments, the mix would gradually shift towards the standard ratio.

Capital Rules and Statutory Trusts to Protect Coin Holders

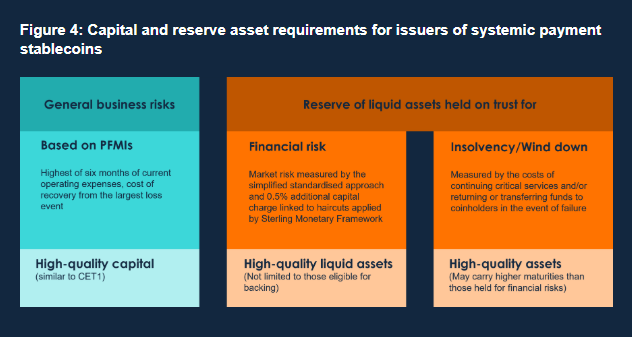

Alongside backing assets, the consultation sets out a framework for capital and liquid reserves that is designed to shield users from losses and to allow orderly wind down if an issuer fails.

Capital held for general business risks would follow international standards used for market infrastructure. Issuers would be required to maintain whichever amount is larger: six months of operating costs or the resources needed to recover from the most severe loss event deemed plausible. The capital instruments they hold must be permanent and capable of absorbing losses, ensuring that the firm can continue operating or wind down in an orderly way.

The framework also introduces two separate reserves. One is designed to absorb financial risks linked to the backing assets, including movements in the value of short-term government securities and any price effects that might arise if those assets need to be sold during periods of stress. The second reserve is intended to cover the cost of keeping essential services running and returning funds to users if the issuer becomes insolvent.

The Bank of England argues that these arrangements offer clearer protection than a debt-based model and help ensure coin holders can be paid out in full and without delay. To reinforce this protection, all backing assets, capital-funded assets and reserves would need to be held within the United Kingdom.

The paper stresses that stablecoin business models must be sustainable in both high and low interest rate environments. Therefore, issuers are encouraged to build revenue from payment services rather than relying heavily on earnings from their government bond portfolios.

How The Bank Will Judge If a Coin Is Systemic

Under the Financial Services and Markets Act, the Treasury can recognize a stablecoin payment system or its key service providers as systemically important. Once recognized, they fall under the Bank’s remit.

The consultation gives more insight into how the Bank of England will advise on these decisions. Key factors include user numbers, transaction volumes, the value of coins in circulation and the extent to which the coin is relied upon for everyday payments, corporate treasury flows or wholesale transactions.

The Bank of England also takes into account whether users could easily switch to another form of money. A coin that is deeply embedded in a large technology or commerce platform, with tightly integrated wallets, is more likely to be judged systemic than a coin used mainly within crypto trading.

Regulators will also look at links to banks, payment systems and market infrastructure. The Bank of England argues that fixed numerical thresholds could be misleading, potentially classifying a large but low-risk coin as systemic or overlooking a smaller coin with stronger systemic links.

Holding Limits Intended to Protect Bank Lending

The Bank of England acknowledges that a rapid shift from bank deposits into stablecoins could shrink funding available to the banking system and restrict credit to households and firms. To manage this transition, it proposes holding limits for systemic stablecoins.

For individuals, the suggested limit is 20,000 pounds per coin. For businesses, the limit is 10,000,000 pounds per coin, although firms that need larger balances for operational purposes may be granted exemptions. The Bank views these limits as temporary tools that can be lifted once banks adapt their funding structures.

Redemption Rights, Fees and Access to Payment Rails

The Bank of England stresses that coin holders must always be able to convert their tokens into an equivalent amount of fiat currency. Issuers would be required to initiate redemption payments by the end of the business day in which a valid request is made, provided user verification checks are completed.

Fees for redemptions should be kept to a minimum and reflect only the cost of providing the service, with no scope for passing losses on to users. The Bank of England cautions that high charges could drive customers to offload their coins on secondary markets, creating the risk of disorderly price moves.

To make redemptions reliable, issuers are expected to hold direct access to key sterling payment systems rather than routing transactions entirely through sponsoring banks.

The Bank of England says direct access should reduce operational risks and strengthen the ability to settle between stablecoins, e-money and bank deposits at par.

Technology, Ledgers and Operational Risks

The consultation confirms that systemic stablecoins may use public permissionless blockchains. However, the Bank of England notes that such networks raise questions over accountability, settlement finality and cyber resilience. It expects issuers to manage these risks and to meet regulatory standards regardless of the technology they adopt.

The Bank also plans to extend its existing standards on governance, outsourcing and operational resilience to stablecoin arrangements, and will set out a dedicated supervisory approach in 2026.

Wallet Providers and Overseas Issuers

For custody of stablecoins, the Bank of England plans to rely on the Financial Conduct Authority’s upcoming rules for safeguarding qualifying crypto assets, which would apply to custodial wallet providers that hold stablecoins for users.

The Bank recognizes that some users may prefer unhosted wallets where they control their own keys. While these wallets reduce intermediary risk, they also pose challenges for enforcing holding limits and executing payouts during wind down. The central bank will monitor their role as the market evolves.

Additionally, non-UK firms issuing sterling stablecoins that become systemic would be required to establish a subsidiary in the United Kingdom and hold all backing and reserve assets domestically.

For non-sterling systemic stablecoins issued overseas, the Bank of England is open to relying on the home regulator if that authority has a framework that delivers broadly similar outcomes and maintains strong cooperation arrangements with the United Kingdom. If those conditions are not met, the Bank says it would put alternative safeguards in place.

Next steps

The consultation runs until February 2026, after which the Bank of England will use the feedback to finalize detailed codes of practice and its supervisory approach.

Officials say the goal is to build a stable, trusted and interoperable system of digital money as stablecoins move from niche crypto use cases into mainstream payments and financial markets.

Read More: Canada Targets Emerging Tech in 2025 Budget, Regulates Stablecoins & Invests Nearly C$1 Bn in AI